The Exor Board of Directors’ meeting approved today the 2022 First Half-year Report.

NET ASSET VALUE (NAV)

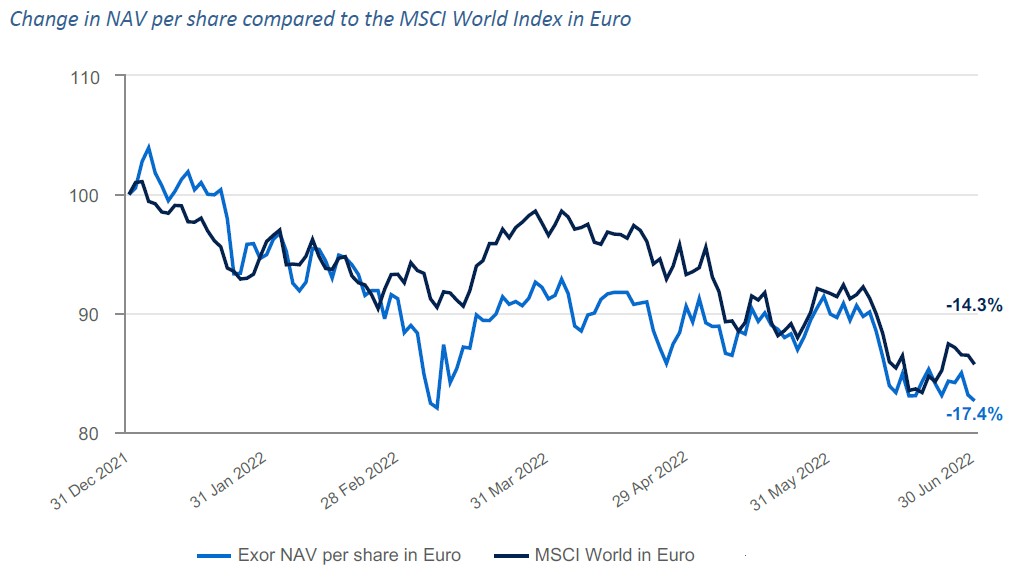

At 30 June 2022 Exor’s NAV is €25,505 million compared to €31,069 million at 31 December 2021. At 30 June 2022 Exor’s NAV per share amounts to €109.41 compared to €132.41 at 31 December 2021, a decrease of €23.00/share or 17.4%. This compares to a decrease of 14.3% for the MSCI World Index in Euro.

SUMMARY OF CONSOLIDATED FINANCIAL RESULTS

RESULT: Exor closed the first half of 2022 with a consolidated profit of €265 million; the first half of 2021 ended with a consolidated profit of €838 million. The net decrease of €573 million is mainly attributable to the share of the result of subsidiaries and associates (€1,022 million), including unrealized losses of the fixed income portfolio of PartnerRe. The result of the first half 2021 included a non-recurring loss (€507 million) arising from the deconsolidation of FCA, following the merger with PSA.

EQUITY: At 30 June 2022 the consolidated equity attributable to owners of the parent amounts to €18,061 million, with a net increase of €1,302 million, compared to €16,759 million at 31 December 2021.

NET FINANCIAL POSITION: The consolidated net financial position of the Holdings System at 30 June 2022 is a negative €4,546 million and reflects a negative change of €622 million compared to the negative financial position of €3,924 million at 31 December 2021, mainly due to: payment of the Exit Tax to the Italian Tax Authorities (€746 million), investments (€355 million), dividend distributed (€100 million), buyback (€100 million), partially offset by dividends received from investments (€794 million).

SIGNIFICANT EVENTS IN THE FIRST HALF OF 2022

Significant events below refer to Exor N.V. and the Holdings System as defined in the 2022 Half-year Report, except those already presented in the 2021 Annual Report as “Subsequent Events”.

Investment in Lifenet

On 21 June 2022, following receipt of the required regulatory approvals, Exor invested €67 million to acquire a 45% stake in Lifenet S.r.l., an Italian company active in the healthcare sector, particularly in the management of hospitals and outpatient clinics.

Increase in the investment in Exor Seeds

In the first half of 2022 Exor increased its investment in Exor Seeds by $46 million (€42 million).

Exor buyback program

In the first half of 2022, under the share buyback program launched on 8 March 2022, Exor purchased on Euronext Milan 1,524,103 ordinary shares for a total invested amount of €100 million, as the first tranche of the program.

At 30 June 2022 Exor held in total 10,797,181 ordinary shares in treasury (4.48% of total issued share capital).

SUBSEQUENT EVENTS

Creation of the new long-term partnership between Exor and Institut Mérieux in global healthcare

On 1 July 2022 Exor and Institut Mérieux, the privately held global healthcare holding company of the Mérieux family, signed a long-term partnership agreement under which Exor would obtain, by way of a reserved capital increase, a 10% shareholding in Institut Mérieux.

On 29 July 2022 Exor paid an initial amount of €278 million, corresponding to one third of the €833 million total investment, by way of a reserved capital increase. The remaining amount is expected to be contributed within the following 12 months. As part of the partnership sealed with the Mérieux family, John Elkann and Benoît Ribadeau-Dumas have joined Institut Mérieux’s board of directors.

The partnership with Exor will provide further resources to support Institut Mérieux’s growth as it continues its work to provide ever more innovative solutions to today’s and tomorrow’s complex global health issues.

Completion of the disposal of PartnerRe

On 12 July 2022 Exor completed the sale of PartnerRe to Covéa for a total cash consideration of $9.3 billion

(approximately €8.6 billion), as agreed in the Definitive Agreement signed on 16 December 2021.

The cash consideration is split as follows: $4.8 billion in USD (including a net price adjustment of which $0.18 billion was already paid by PartnerRe as a special dividend to Exor in March 2022) and €3.8 billion in Euro. The Euro portion of the proceeds was fixed at the signing of the Memorandum of Understanding in October 2021 and the USD portion has not been hedged.

Following the disposal, Exor will recognize in the consolidated income statement the difference between the sale price and the carrying amount of PartnerRe at the date of loss of control over the subsidiary, preliminarily estimated in a range of €2 billion.

Following the closing of the transaction, Exor and Covéa will continue their reinsurance cooperation. At closing, Exor acquired from Covéa interests in special purpose reinsurance vehicles managed by PartnerRe for approximately $725 million. These vehicles invest in property catastrophe and other short-tail reinsurance contracts underwritten by PartnerRe. Covéa, Exor and PartnerRe will also continue to invest jointly in Exormanaged funds with reinforced alignment of interests.

Transfer of stock exchange listing to Euronext Amsterdam

On 29 July 2022, Exor’s Board of Directors approved the transfer of the listing of the Company’s ordinary shares to Euronext Amsterdam, a regulated market organised and managed by Euronext Amsterdam N.V., which hosts some of Europe’s leading corporations.

The listing and trading of the Exor’s ordinary shares on Euronext Amsterdam commenced on 12 August 2022, after receiving the formal approvals from the Euronext Listing Board and the Dutch Authority for the Financial Markets (the “AFM”).

The move aligns the Company’s listing venue with its established legal structure as a Dutch registered holding company. This further simplification of Exor’s organisational structure results in the Company being overseen by a single country regulatory authority, namely the Dutch Authority for the Financial Markets (AFM).

The delisting of Exor’s ordinary shares from Euronext Milan will be effective from 27 September 2022.

Exor buyback program

On 29 July 2022, Exor announced its intention to continue with the execution of the buyback with a second tranche of up to €250 million to be executed on Euronext Amsterdam and Euronext Milan. The shares repurchased under the second tranche may be used to meet the obligations arising from the Company’s new equity incentive plan 2022-2024. The second tranche will be conducted in the framework of the resolution adopted at the AGM held on 24 May 2022.

In the period from the announcement of the second tranche to the date of this press release, Exor purchased 581,451 ordinary shares for a total invested amount of €37.1 million, holding in total 11,378,632 ordinary shares in treasury (4.72% of total issued share capital).

PERFORMANCE OF PRINCIPAL COMPANIES

Exor 2022 Half-year Financial Report, which will be available at the head office of the company and on the website www.exor.com in the time frame established by law, includes comments on the performance of all the principal companies.

2022 OUTLOOK

Exor N.V. does not prepare budgets or business plans, nor does it publish forecast data or data on the basis of which it is possible to calculate forecast data.

Certain Exor operating subsidiaries and associates (Ferrari, Stellantis, CNH Industrial and Iveco Group) publish forecast data on their performance. Other operating subsidiaries (Juventus) publish information on the foreseeable outlook. Additional information is provided under “Review of performance of the main companies” in the Board Report.

The forecast data and information of the above mentioned operating companies and associates are drawn up autonomously and communicated by the respective companies and are not homogeneous. Quantitative forecast disclosures prepared by these operating companies and the type of information provided, as well as the underlying assumptions and calculation methods vary according to the accounting principles applicable to each subsidiary and the conventional application practices in the respective sector of reference.

Exor N.V. in fact, is a holding company without a specific business of reference, head of a diversified and non integrated group that operates in different segments and does not exercise direction and coordination activities over its subsidiaries, which operate in a completely independent manner.

Exor N.V. deems that the forecasted data and information of the subsidiaries and associates are not significant or suitable for the purposes of providing indications about the prospective economic trend of Exor N.V.’s operations, nor represent a forecast or estimate of the company’s results. Therefore, in assessing Exor N.V.’s future prospects it is not possible to rely on the data and prospective information published by the aforesaid

operating subsidiaries and associates.