Letter to Shareholders

When reflecting on the past twelve months, I recalled the wise words of my close friend and mentor, Ratan Tata: “One seems to learn much more during difficult times, so perhaps one should not be averse to them.”

His thoughtful counsel guided me, and it was a great sadness to lose him in October. Ratan leaves behind an incredible legacy having led Tata Group from the past to the future and from India to the world.

We will hold your wisdom and memory close to our hearts, Ratan.

Exor in 2024

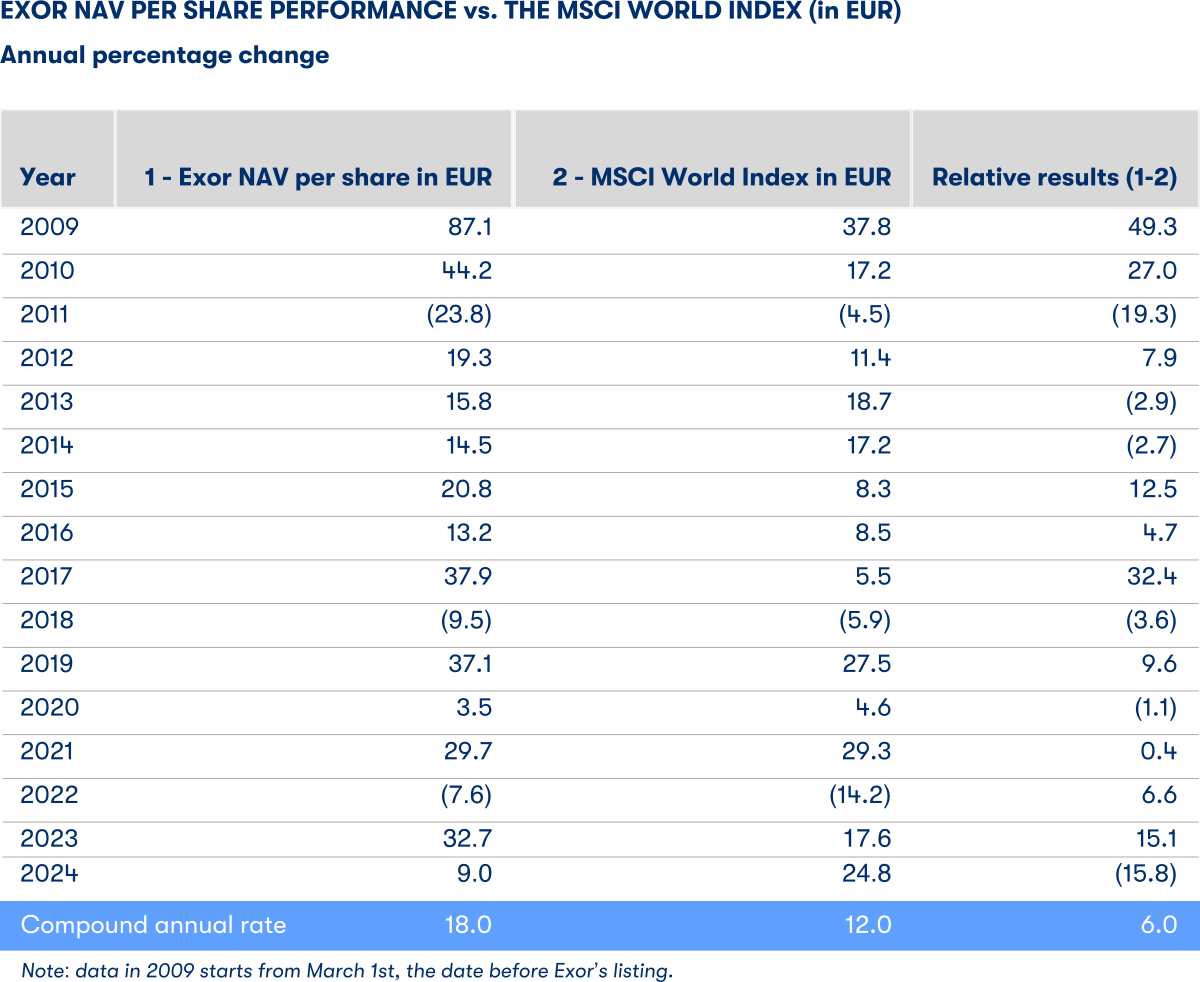

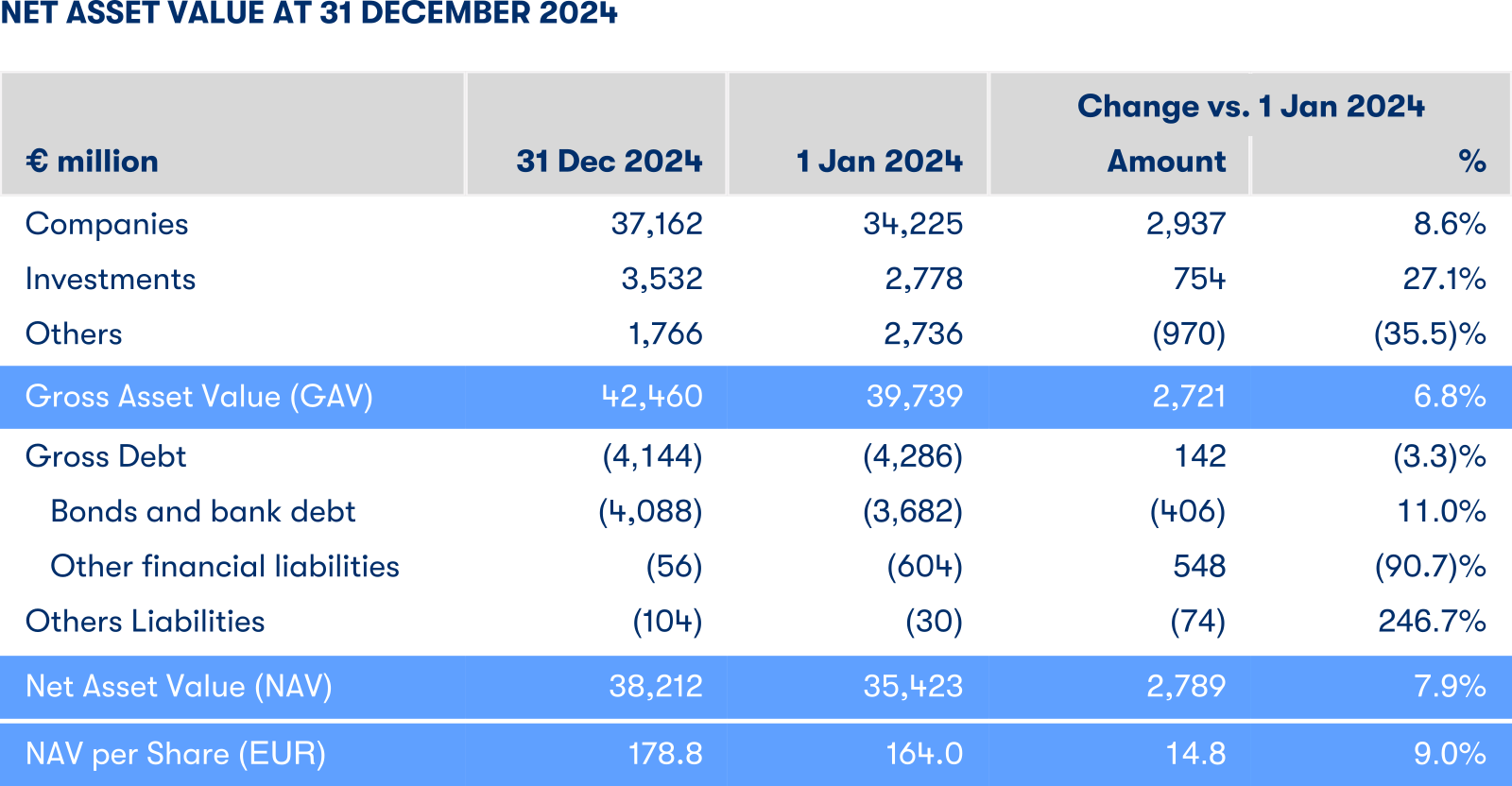

In 2024, Exor’s Net Asset Value (NAV) per share increased by 9.0% underperforming our benchmark, the MSCI World Index, by 15.8 percentage points.

The main driver of our NAV per share growth this year was the excellent performance of our largest and most valuable company, Ferrari, which increased by 35%.

Companies (88% of GAV)

Exor’s purpose is to build great companies. To do this, we need to align our ownership with the governance and leadership of our companies so that we can provide them appropriate support and challenge, both in good and bad times, as they pursue their paths to greatness.

Ferrari races ahead

Ferrari enjoyed an excellent 2024 as it combined continued strong financial performance with encouraging results in racing, sports cars and lifestyle. Over the course of the year, we launched new models: the Ferrari 12Cilindri, coupé and spider, and the F80.

The Ferrari 12Cilindri draws inspiration from the legendary Grand Tourers of the 1950s and 1960s. It embodies the spirit of the front-mounted Ferrari V12 two-seater with its effortless combination of elegance, versatility, and performance.

The F80 is Ferrari’s latest supercar and was released with a limited run of just 799 examples. With a combined maximum horsepower of 1,200, it is the most powerful sports car to ever come out of the Maranello factory. Packed with advanced technological solutions, it is the new symbol for cutting-edge innovation. The F80 takes inspiration from the 499P hypercar which repeated its success in 2024 at Le Mans, coming home in first place again.

As Ferrari continues to build sports cars that combine technological brilliance with unparalleled aesthetics, innovation will always play a key role. So, we were delighted to have welcomed the President of Italy, Sergio Mattarella, to inaugurate the e-building in June. The new building will provide our customers the freedom to choose between Ferraris with combustion, hybrid and soon electric engines. It will also develop and produce strategic components for future models. This pinnacle of engineering, designed to achieve the highest levels of energy performance, is powered completely by renewable resources.

Ferrari’s excellent 2024 translated into another impressive year of financial results. Net revenues grew by 12% versus 2023 to reach €6.7 billion with an EBITDA of €2.6 billion (38% margin). All 2024 targets were exceeded and 2025 promises to be exciting with the arrival of Lewis Hamilton and the launch of the first fully electric Ferrari.

Stellantis navigates a challenging 2024

While Ferrari continued to thrive last year, Stellantis experienced a tough twelve months following a record 2023.

Before I delve into the challenges that Stellantis faced, it’s worth reflecting on what the merger between FCA and PSA in 2021 gave birth to: a leading global automaker and mobility provider with a well-balanced geographical presence and a portfolio of iconic brands covering a wide range of key vehicle segments.

Stellantis struggled in 2024 due to a combination of external and internal factors. Global industry volumes for the year were weaker than initially forecasted, with lower demand across our major markets of the US and the EU driven by regulatory uncertainty, increased customer price sensitivity and reduced government incentives for electric vehicles (EVs). We expect some of these external factors to continue in 2025.

Additionally, intensified competition, particularly from Chinese automakers offering lower-priced EVs, contributed to weaker demand for incumbent OEMs and exerted downward pressure on vehicle pricing. Overall Chinese exports of electric passenger vehicles in 2024 totalled 1.3 million units, a year-on-year increase of 24%, according to the China Passenger Car Association. This trend has been particularly pronounced in important regions for us such as Brazil, the EU and Mexico, where Chinese brands have successfully captured market share.

Stellantis views this challenge as an opportunity and, as I outlined last year, has invested in Leapmotor with whom we have developed a joint venture together: Leapmotor International. Leapmotor delivered strong results in 2024 with over €4 billion in revenues (more than 90% increase versus the prior year) and a gross margin of 8.4% (versus 0.5% in 2023), reaching profitability in Q4, significantly earlier than forecasted. Similarly, Leapmotor International is off to a good start, exporting almost 14,000 units overseas and establishing 400 outlets with sales and after-sales services worldwide last year.

Beyond these broader market headwinds, Stellantis faced significant internal difficulties throughout the year. The large-scale retooling of factories to support the transition to new platforms and products able to support electric, hybrid, and internal combustion engine variants, as well as the increasing technology content of its new products, created temporary gaps in its product lineup, limiting the company’s ability to meet demand. In North America, underperformance in critical go-to-market functions, particularly sales and marketing, further compounded these issues. As a result, inventory levels swelled, straining dealer relationships and requiring aggressive discounting to clear excess stock.

Following mounting pressure over the company’s performance and deteriorating alignment with the Board, Carlos Tavares resigned as CEO in December 2024. On the back of these external and internal issues, Stellantis delivered very disappointing results with net revenues of €156.9 billion (-17% versus the year prior) and an adjusted operating income of €8.6 billion (-64% compared to 2023) with an adjusted operating margin of 5.5%.

I was asked by the Stellantis Board to chair the Interim Executive Committee that is working to lay a strong foundation for the company to succeed in the future, with key actions already taking place in the first quarter of 2025.

We have focused on product launches, adjusting plans to ensure the right nameplates, with the right powertrains, are coming at the right times. In response to consumer preferences, we are reintroducing classic American models, including a Jeep Cherokee-sized SUV and the gas-powered Dodge Charger, and pausing the rollout of the all-electric Ram truck to better align our offering with current market demands in North America.

We’re also building trust with all our stakeholders and empowering our regional leadership, who are closer to customers and understand better what they want. We are streamlining operations as well as reinforcing quality at the heart of everything we do.

Over the last four months, I have had the chance to spend a lot of time with the different departments, regions and most importantly the wonderful people across Stellantis. I am very grateful for their attitude and efforts as we work together to bring back our company to where it should be.

We are making good progress at the Special Committee for the appointment of the new CEO, which we aim to conclude in the first half of 2025. We want to find a leader who aligns with the reference shareholders and the rest of the Board’s belief that while Stellantis is facing a period of adversity, it will be one that will pave the way for future growth and success.

CNH manages the cyclical downturn

In a similar story to Stellantis, CNH achieved strong performance in 2021 and 2022 as demand rebounded following the initial wave of the pandemic and was supported by stable prices in farmed commodities and the company’s internal cost reduction actions. Sales increased year over year for tractors, combines and construction machines in all regions, with some showing very strong demand.

While the performance in this period was strong, there are real opportunities for CNH to improve further. Its margins still lag behind those of the industry leaders, and although it has taken a substantial step forward in its precision and automation farming journey with the acquisition of Raven Industries in 2021, more work is needed to integrate these technologies with its trusted and extensive product range.

Today, CNH is managing a cyclical downturn in both the agriculture and the construction sectors. Net sales from industrial activities for 2024 reached $17.1 billion, a 23% decrease versus 2023, with an adjusted EBIT of $1.4 billion (8% margin versus 12% in 2023).

Farmers are dealing with reduced incomes driven by lower commodity prices and higher input costs. Regions such as Brazil and Europe are seeing weak levels of demand, and the North American row crop market is experiencing softness with high horsepower tractors down 16% year-on-year. CNH is the market leader in combines, so it suffered as annual global sales decreased in EMEA by 43% and in South America by 31%.

In July 2024, Gerrit Marx was appointed as the new CEO of CNH. He and his team believe the current downturn creates an opportunity to strengthen the company. They are now focused on reducing supply chain costs, improving operations and accelerating the development of precision farming technologies.

This appointment illustrates how we can support and grow talent across our companies. Gerrit joined CNH in 2019, as President of Commercial and Specialty Vehicles, and then became CEO of Iveco Group when it was spun off from CNH at the start of 2022. In this role, he grew Iveco Group’s net revenues from €14 billion to over €16 billion by the end of 2023 and adjusted EBIT from €527 million (3.7% margin) to €940 million (5.8% margin).

Both the cases of Stellantis and CNH illustrate the role Exor can play in its companies as the largest shareholder with the aim to maintain alignment between their ownership, governance and leadership.

To build great companies, we fundamentally believe that you need great people. While we value continuity of leadership, we will support change, when needed. Exor wants to make sure we have the right people in the right seats.

Our continued conviction on healthcare

Over the last few years, I have gone into detail about the opportunities we see in the healthcare sector as it sits at the intersection between societal needs and technological progress. Despite our positive outlook on the industry, 2024 was a difficult year across the board for healthcare players as softness in the Chinese market and further post-COVID normalisation led to weaker results. Still, our companies performed better than the sector in 2024.

Our original investment thesis in Philips was based around three pillars: clarity on the Sleep & Respiratory Care litigation, execution of the turnaround plan and the company’s continued exposure to attractive markets. 18 months in, our conviction in Philips remains strong.

In 2024, the company reached significant milestones to resolve the Respironics recall, which in turn provided substantial clarity on the road ahead. Philips agreed to the terms of the US Department of Justice (DOJ) and the Food and Drug Administration’s Consent Decree. Settlements were also reached in the US personal injury litigation and medical monitoring class action: Philips Respironics would pay a total of $1.1 billion. The company also concluded an agreement with insurers to pay Philips €540 million to cover Respironics recall-related product liability claims. These important milestones have played a key role in creating a clear path forward and Philips is committed to resolve the effects of the recall.

The company is starting to see the benefits of its turnaround plan. Prior to our investment, Philips had closed 2022 with €17.8 billion of sales, 7.4% of Adj. EBITA margin and a negative free cash flow of €1.0 billion. Fast forward to the end of 2024, and the company closed with over €18.0 billion in sales, an adjusted EBITA margin of 11.5% and positive free cash flow of €0.9 billion. While there is still room for improvement, especially in terms of top line growth, the margin increase is arriving earlier than expected.

Philips has continued to maintain its leadership position in attractive segments such as Image Guided Therapy, Ultrasound, Monitoring, Enterprise Informatics and Personal Healthcare. Despite the weaker demand in China, we still believe these remain full of potential for further global growth and margin expansion.

With the additional clarity and continued confidence in the company’s turnaround as the litigation issues were largely resolved, we invested an additional ~€500 million in Philips. At the end of 2024, our stake grew to over €4 billion, representing close to 10% of our GAV, with our ownership at 17.5%. We continued to buy at the beginning of this year and have increased our shareholding to 18.7%.

2024 proved to be not only an important year for Philips, but also for bioMérieux, Institut Mérieux’s largest company, as it presented its ambitious GO•28 mid-term strategic plan. Its goal is to achieve a 7% sales CAGR from 2024 to 2028, by reinforcing its leadership positions in Microbiology (especially, Antimicrobial Resistance) and Molecular testing (e.g., maintaining leadership positioning in its testing platform).

2024 was an excellent launchpad for the GO•28 plan as the company delivered strong results. Sales grew by 10%, significantly higher than the 7% CAGR of the plan. The main drivers behind this growth were BIOFIRE non-respiratory molecular tests (up 17%), the positive traction of the recently launched point-of-care solution SPOTFIRE (that I will discuss below) and the solid dynamics in Microbiology (up 8%). Also, in terms of profitability, bioMérieux reported a cEBIT margin of 16.9% as of 2024, representing a 150 basis points improvement at constant currency and scope versus 2023.

We are extremely pleased by bioMérieux’s strategic expansion into the point-of-care space through the launch of SPOTFIRE, a fast and easy-to-use testing platform that allows patients to be tested directly on site, with shorter waiting times and earlier actionability. The demand is clear as the installed base grew to 3,000 units by year end despite only being released in 2023. bioMérieux strongly believes in its potential with a projected €450 million in sales by 2028.

In January 2025, bioMérieux further strengthened its point-of-care presence through the acquisition of SpinChip, a privately-held Norwegian diagnostics company that has developed a game-changing immunoassay diagnostics platform for heart attacks. The small analyser can screen a blood sample on site in 10 minutes with the same high-sensitivity quality as laboratory instruments. We believe bioMérieux’s exposure to attractive segments like point-of-care will enable its continued success.

Since the beginning of our partnership, we have also supported the Mérieux family in their portfolio management actions. In October 2024, Mérieux NutriSciences (the second largest company in Institut Mérieux’s portfolio and second player globally in food safety, quality, and sustainability) announced it had entered into an agreement to acquire the food testing business of Bureau Veritas.

The transaction will create a business with $1 billion in revenue, significantly reinforcing Mérieux NutriSciences’ position as a global leader and expanding its geographic footprint, by doubling its presence in Asia Pacific and Canada, and providing access to new regions with considerable growth potential.

Over the long term, we remain excited about the future of the healthcare industry and our companies in it.

Clarivate has a difficult start

As I have outlined in the past, we believe that technology can play a key role in generating value within our companies as well as being an interesting standalone sector for new opportunities. In particular, we have been interested in data and software businesses as they present significant scalability potential combined with high margins and subscription-based & asset-light business models. Typically, we find that high-quality data businesses enjoy strong moats given they are deeply entrenched in customer workflows.

Last year, I touched on our investment in Clarivate, a global provider in transformative intelligence offering enriched data, insights & analytics, workflow solutions and expert services across Academia & Government, Intellectual Property and Lifesciences & Healthcare. Through these three segments, the company has built a portfolio of leading software solutions on a worldwide scale: more than 45,000 clients use their data and services with annual customer renewal rates in excess of 90%.

Clarivate is facing a series of internal and external challenges that saw its share price drop by over 40% over the course of 2024. Despite possessing strong assets in each of its segments, built largely through rapid inorganic growth, it is still struggling with integration issues from its previous strategy. This has also impacted the company’s focus on innovation alongside ever-growing competition in all its markets.

The company is being affected by a slowdown of its end markets over the last few quarters. This is especially true in the IP industry where filings and particularly renewals have been lower versus historical trends and smaller healthcare and biotech funding, whose levels normalised post pandemic. In addition, there is currently some uncertainty around the academic and government budget discussions in the US which might impact the company.

Given the struggles it was facing, Clarivate’s Board felt the need for change and Matti Shem Tov was appointed as CEO in August. He brings over 20 years of sector expertise as well as familiarity: he was previously CEO of the academic software provider ProQuest, which was subsequently acquired by Clarivate.

The leadership team aims to drive the company’s future growth through key pillars: business model optimisation (with a renewed focus on subscription revenues), improved sales execution, accelerated innovation and portfolio solutions rationalisation. We believe that Matti and his team are making good progress in positioning the company for long-term success despite the challenging last twelve months.

Mixed performance across our private companies

The performance of our private companies last year was varied, with strong results for Welltec (51% increase in valuation over 2024) and Via (+11%) while others struggled. Like in the past, I would like to reflect on a few of them: Via, Welltec, and Shang Xia.

Via, founded in 2012, reimagines the way cities move by transforming antiquated and fragmented public transportation systems into advanced digital networks. After starting as an investment in our Ventures portfolio, Exor invested $200 million in 2020 and then a further $50 million in 2023 to take our ownership to just under 19%, making us the largest shareholder. Via marries our interests in technology and supporting talented entrepreneurs.

With over 650 customers in more than 30 countries, Via has built a client base of cities and transit agencies of all sizes that include London, New York and San Francisco. Among these clients, Via has also expanded into leading companies like Google and ASML to offer transport solutions for their employees.

Through its platform, clients gain unprecedented access to data and data-driven insights on the performance of their systems, allowing them to rapidly improve efficiency and passenger experience. Its integrated platform – which includes the Remix and Citymapper brands – allows public authorities to manage fixed-route, on-demand, paratransit, school bus, and microtransit services within a single system, supported by AI-powered planning and real-time data.

Via maintained strong momentum in 2024, with rapid and consistent revenue growth that led to an annualised revenue run-rate of $367 million, up more than 30% year-over-year. It continues to be one of the fastest growing late-stage private companies, and their large pipeline of opportunities supports strong revenue visibility into 2025 and 2026, making us very excited about what’s to come.

Welltec, which provides sustainable well completion and intervention solutions for the oil and gas industry, had a very positive 2024 as it delivered industry-leading performance for the third consecutive year. Revenue reached $426 million with an impressive EBITDA margin again exceeding 50%.

This high operational profitability combined with continued cash flow generation allowed the company to significantly deleverage to 0.4x by the end of 2024 (versus 3.1x in 2021). On the back of this excellent year, Welltec will pay its first ever dividend to shareholders in 2025.

Shang Xia is a luxury brand originally founded by Hermès in collaboration with designer Qiong Er. The company combines traditional Chinese craftsmanship with modern design and the use of high-quality materials to create products that enhance customers’ lives today while preserving ancient techniques.

We invested in this company back in 2020, believing that both Chinese and international customers would increasingly value Chinese heritage luxury goods. We still believe this to be true and Shang Xia has many loyal customers.

While the company’s products remained highly valued, it had to deal with a series of challenges. The luxury market declined in China by ~20% in 2024. In addition, Shang Xia had to simplify its business model, which had been complicated by adding fashion to its range of products.

Despite the market challenges in 2024, Shang Xia maintained flat organic revenues, reduced its operating costs by close to 55% and was able to halve its operating losses relative to 2023. The company is positioning itself to be profitable and ready to grow when the market rebounds.

Investments (8% of GAV)

At Exor, we have historically invested in many different ways across diverse asset classes. Going forward, we have decided to concentrate these investing activities in Lingotto, our Investment Management Company that was founded in May 2023.

Last year, I wrote about the spirit and culture that Lingotto was building and since then, we have made excellent progress under the leadership of Enrico Vellano and his team.

The business has expanded to over fifty investment and business professionals, opened a new office in New York to house two of its investment teams and ended the year with more than $6 billion in Assets Under Management (AUM). In 2024, Lingotto also welcomed its first external investors beyond Exor and Covéa. While Lingotto’s success depends on ensuring it grows AUM through performance rather than capital inflows, I have been delighted to see the quality of investors with whom Lingotto has chosen to work, and I’m excited to see how these new relationships progress over time.

I would also like to share some notable highlights from Lingotto’s different strategies. Matteo Scolari has been investing on behalf of Exor since early 2017 and the performance of his strategies was highly impressive once again in 2024. Matteo leads the Intersection Strategy, referring to his belief that breakthrough ideas often occur at the crossroads of different fields. The most material contributor to the positive performance was Intersection’s position in Carvana. This investment was built at the beginning of 2023 when the shares were trading below $10 and at a time of great uncertainty for the company. Since then, the business has recovered remarkably, achieving industry leading growth and profitability, resulting in an approximately 25-fold increase in the share price. Rolls-Royce, the biggest contributor to the Intersection Strategy returns in 2023, continued to perform well in 2024. Under the leadership of the new CEO Tufan Erginbilgiç, the business has recovered strongly as shown by the continuous margin improvement and guidance upgrades throughout the year. On the other hand, the investment in Ocado detracted from strategy returns in 2024. Performance challenges at its largest customer, Kroger, continued to negatively impact Ocado’s share price. The Intersection team views these challenges as temporary and has therefore taken advantage of the weak share price to increase their position.

The Innovation Strategy, led by James Anderson and Morgan Samet, developed significantly in 2024 not only by adding new team members with broad and diverse backgrounds, but also through extending its remit to invest in earlier-stage companies. The strategy now invests through the entire corporate life cycle, from venture capital through to public markets, focusing on the companies with the greatest potential.

This evolution of the Innovation Strategy’s scope follows Exor’s decision to discontinue its Ventures activities. We have decided to enter a monetisation phase with our Ventures portfolio, which will be overseen by our CFO, Guido de Boer.

Lingotto’s other strategies also made important contributions with Nikhil Srinivasan’s Horizon Strategy delivering notable early results from private investments such as Neura Robotics, U-Power, CFG Bank and Engtek. Meanwhile, the Mosaic Strategy, under the leadership of Pam Chan, was formally launched in the second half of 2024 and I look forward to sharing more details on how this strategy progresses in the future.

Others (4% of GAV)

We define liquidity as cash or assets held as financial investments which can be converted into cash. At 31 December 2024, our liquidity was equal to €0.6 billion and was composed of cash and cash equivalents for €0.2 billion and listed securities for €0.4 billion.

In 2024, our liquidity decreased by €0.9 billion mainly driven by the deployment of capital into Companies, Investments and Buyback. This decrease has been partially offset by cash flow from the dividends received from our companies, net of financial and general expenses and dividends paid to our shareholders as well as the monetisation of assets.

In addition, the value of our reinsurance vehicles increased by €0.2 billion due to strong results and positive translation effects, while distributing €0.3 billion from redemptions.

GROSS DEBT AT 31 DECEMBER 2024

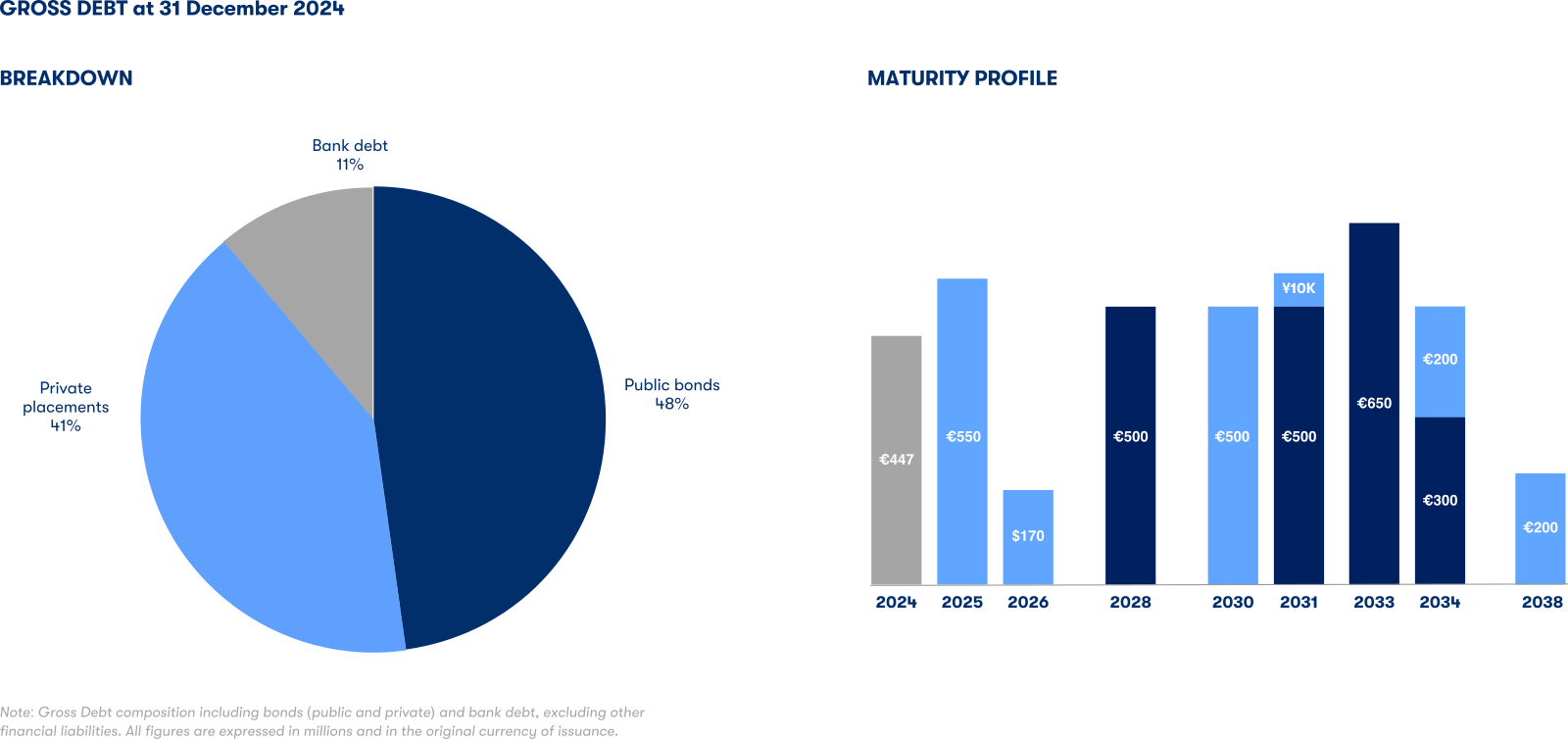

Consistent with our solid capital structure and well-balanced maturity profile, we have continued to focus on efficient debt management. Our Gross Debt at 31 December 2024 was equal to €4.1 billion. In October 2024, we reimbursed €500 million with the proceeds raised earlier in the year from a nine-year public bond issuance at favourable market conditions.

The majority of our debt is made up of bonds with an average maturity of six years and an average cost of 2.7%. Most of this debt (95%) is denominated in Euro and carries fixed interest rates. We remain committed to maintaining our A- rating and will continue to prioritise a strong balance sheet.

Investment entity

In 2024, we aligned our external reporting with the way in which our investors, analysts, rating agencies and banks perceive, analyse and evaluate us. Reporting as an Investment Entity has enabled us to be more consistent in how we measure our performance, take capital allocation decisions and incentivise management.

This change reflects the evolution of our portfolio activity and composition as well as the implementation of a portfolio review process which we use to monitor, assess and, where applicable, rebalance our portfolio.

With the first-time application in our Half-Year 2024 results, our financial reporting is now simpler, more relevant and easier to read with key metrics, such as Net Asset Value, now being audited.

Since Exor first spun Ferrari out from FCA, the company has delivered a total shareholder return of over 11x (the MSCI World delivered just shy of 3x in the same timeframe). Its contribution to our NAV had gone from 15% in 2016 to nearly 50% as our largest and most valuable company.

At Exor, when we think about our portfolio’s composition, we like concentration because it encourages us to remain focused on what matters but we also recognise that we need some balance. This transaction both reduces the concentration in our portfolio and provides the funds for a sizeable new acquisition. As I underlined when we made the announcement, our support for Ferrari and our belief in the company’s potential is unwavering.

Last year, I spoke about the CERN Science Gateway: a futuristic building that draws people from all corners of the world to come and experience the wonder of science. This month, the centre welcomed its 550,000th guest. In 2025, we are also continuing to strengthen Exor’s commitment supporting social and technological progress through initiatives such as Matabì, our flagship educational initiative with Fondazione Agnelli, and Italian Tech Week.

Our love of technology is embodied in Italian Tech Week – our annual gathering in Torino of the greatest minds, talents and companies in the tech space. This event is run by Diyala D’Aveni and her team at Vento, Italy’s most active private early-stage venture capital fund.

In March of this year, we announced the launch of a second fund, with a commitment of €75 million over the next five years, to find the boldest Italian startup founders globally.